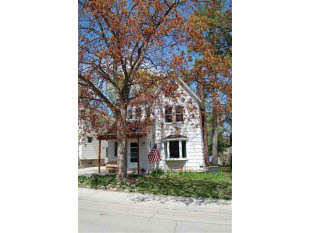

We first started marketing our house on Roberts Court for sale by owner on the FSBO Madison site in March 2010. On April 18, I signed a listing contract to put the house for sale on the MLS. The listing agent, Bill Lorge of Badger MLS, set the price. We thought the price was high and dropped it within the first week. The US First Home Buyer's credit was set to expire 30 April. We had showings all through April. We heard that Buyer's are expecting new cabinets in the bathroom. We also heard that we were "overpriced". We agreed with both comments, so we dropped the price again, however this time we felt we were really close to being priced "correctly". Then came up with a plan to have the bathroom remodeled.

We took the house off the market at the end of May so we could get the bathroom remodeled. We also determined to get the house appraised so we would know it's value. Besides, we did not receive any showing requests after April 30, after the credit expired.

When I questioned Real Estate Agents what price they thought the house should be, I kept hearing a number that sounded a lot like the Assessed Value of our house. Suddenly I realized, the market in Madison believes the assessed value (or below) is what the market value of the house should be! No wonder we weren't getting any serious interest! Our asking price is $40K above the City's assessed value! My thesis was confirmed by a Realtor who ran the numbers based on sales data for Madison.

I called the City Assessor's office to determine what could be done to get the house reassessed. It turns out I missed the "deadline" - a deadline I was not notified of as my assessment was left unchanged - to have the house reassessed in 2010.

With this new understanding, we decided not to continue to market the house for sale until the assessment more closely reflects the appraised value.

We received the bank's appraisal yesterday. Our asking price was $4000 over the appraised value. We were right on!

Maybe we'll sell the house on Roberts Court next year......